Health Plans for Individuals and Families

Shopping for health insurance invites a lot of questions:

- How much will it cost?

- Can I still see my doctor?

- What benefits does it include?

- Are my prescription drugs covered?

Benefits of a Blue Cross NC Plan

How to Shop for a Health Plan

When shopping for a health plan, you need to think about four things:

- Network

- Copayments, Deductibles and Coinsurance

- Subsidies

Network

The larger the network, the more doctors and drugstores there are in that network. Larger networks tend to have fewer limits when you need to find a doctor or prescription drugs. But, it also means the health plan may cost more.

Keep in mind that even though we offer out-of-network coverage too, you'll save the most money when you see a doctor or visit a pharmacy in your plan's network.

Keep in mind that even though we offer out-of-network coverage too, you'll save the most money when you see a doctor or visit a pharmacy in your plan's network.

Copayments, Deductibles and Coinsurance

Health plans are available with a couple of payment combinations and options. The type you choose determines how much you'll pay for care when you go to the doctor, pharmacy or hospital.

|

Copayments

A copayment is a fixed dollar amount you pay for a covered service at the time you receive it. For example, you may have a plan that charges a $20 copay for a regular doctor visit. All you'll need to pay is your $20 copay. Plans with copays tend to be more expensive. But, you'll know the cost of the visit before you go. |

Deductibles

A deductible is the amount you owe for covered health care before your health insurance company starts to pay. For example, let's say you have a $3,000 deductible and you've paid $2,000 toward it. You just had an MRI that costs $1,500. You'll have to pay $1000 to reach your deductible. After that, you'll only pay part of the remaining $500 based on your coinsurance percentage. |

Coinsurance

Coinsurance is your share of costs for health care expenses based on a percentage of those costs. After you've met your deductible, you may be charged coinsurance for health care services. The cost of the service will be split between you and your insurance company. So, if you get a $100 bill for a chest X-ray and you have a 30% coinsurance amount, you'll need to pay $30 and your insurance company will pay the rest. |

Subsidies

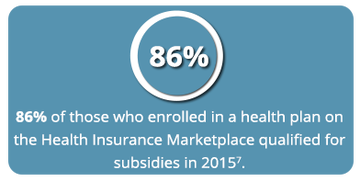

To help make health plans more affordable, the federal government offers subsidies and cost sharing reductions for plans purchased on the Health Insurance Marketplace. A subsidy (financial aid) from the federal government is available to help low and middle-income Americans with their health insurance premiums. The amount of the subsidy is based on you/your family's earnings and household size4.

These subsidies can help you afford a health plan that you may have considered outside of your budget.

Contact us to see if you qualify for a subsidy.

These subsidies can help you afford a health plan that you may have considered outside of your budget.

Contact us to see if you qualify for a subsidy.

Example Plans

|

If you you're healthy, see a doctor less than a couple of times a year and don't have a specific doctor you want to keep, you may want to consider a plan with these features11:

|

Important Information. Advantages of health care coverage with Blue Cross NC include:

- No referrals needed to see a specialist

- 24/7 Telehealth care options for behavioral and physical health, available in English and Spanish

- Access to a 24-hour nurse hotline

- Convenience of 90-day prescription mail order option

- No waiting periods for pre-existing conditions

- Annual wellness visits

- Coverage in- and out-of-network

- Programs to help you stop smoking, including counseling and nicotine replacement therapy like patches, gum, and lozenges

- Access to Blue365® deals and discounts from top health and wellness retailers around the country

- Please see 2023 Health Plans Brochure for more information.